The Only Guide for G. Halsey Wickser, Loan Agent

Table of ContentsSome Known Questions About G. Halsey Wickser, Loan Agent.Get This Report on G. Halsey Wickser, Loan AgentGet This Report about G. Halsey Wickser, Loan AgentFascination About G. Halsey Wickser, Loan AgentG. Halsey Wickser, Loan Agent - Questions

They may bill lending origination charges, ahead of time costs, funding management fees, a yield-spread costs, or simply a broker commission. When collaborating with a home loan broker, you must clarify what their cost framework is early on in the procedure so there are no surprises on closing day. A home loan broker typically just makes money when a funding closes and the funds are launched.The majority of brokers do not cost debtors anything up front and they are usually safe. You ought to use a mortgage broker if you wish to find access to home mortgage that aren't readily marketed to you. If you do not have incredible debt, if you have an unique loaning scenario like owning your own service, or if you simply aren't seeing home loans that will certainly help you, then a broker could be able to get you accessibility to fundings that will certainly be advantageous to you.

Mortgage brokers may likewise be able to help finance hunters get approved for a lower rates of interest than the majority of the commercial lendings supply. Do you require a home loan broker? Well, collaborating with one can conserve a borrower effort and time during the application procedure, and possibly a great deal of money over the life of the loan.

G. Halsey Wickser, Loan Agent Things To Know Before You Buy

A specialist home mortgage broker comes from, bargains, and processes household and industrial mortgage fundings in support of the client. Below is a 6 point overview to the services you ought to be used and the expectations you should have of a professional home loan broker: A mortgage broker offers a wide variety of home mortgage finances from a number of various lending institutions.

A home loan broker represents your interests rather than the passions of a loan provider. They must act not just as your agent, but as an educated professional and problem solver - Mortgage Broker Glendale CA. With accessibility to a wide variety of home mortgage products, a broker has the ability to use you the biggest worth in regards to rate of interest, repayment amounts, and finance items

Several circumstances demand greater than the simple usage of a 30 year, 15 year, or flexible price home loan (ARM), so innovative home mortgage strategies and advanced remedies are the benefit of functioning with a seasoned mortgage broker. A home mortgage broker browses the client via any kind of circumstance, taking care of the process and smoothing any type of bumps in the road along the road.

Examine This Report about G. Halsey Wickser, Loan Agent

Borrowers who discover they require bigger finances than their financial institution will certainly approve likewise gain from a broker's knowledge and capability to successfully get funding. With a mortgage broker, you just require one application, instead than completing forms for every private lending institution. Your home loan broker can provide a formal contrast of any kind of fundings advised, directing you to the details that properly represents cost distinctions, with present rates, points, and closing prices for each loan mirrored.

A trustworthy home loan broker will certainly reveal how they are paid for their services, along with information the overall expenses for the funding. Customized solution is the setting apart factor when picking a home loan broker. You ought to expect your home loan broker to help smooth the means, be offered to you, and suggest you throughout the closing process.

The trip from fantasizing concerning a new home to actually possessing one may be full of challenges for you, particularly when it (https://halseyloanagt.carrd.co/) pertains to securing a home mortgage lending in Dubai. If you have been assuming that going right to your financial institution is the most effective path, you could be missing out on a less complicated and potentially much more beneficial alternative: collaborating with a home loans broker.

Our G. Halsey Wickser, Loan Agent Diaries

One of the substantial advantages of making use of a mortgage consultant is the specialist financial suggestions and crucial insurance coverage support you obtain. Mortgage professionals have a deep understanding of the different financial products and can assist you choose the appropriate home loan insurance coverage. They make certain that you are effectively covered and give suggestions tailored to your economic scenario and lasting goals.

A home mortgage brokers take this worry off your shoulders by managing all the documentation and application procedures. Time is cash, and a home mortgage loan broker can save you both.

This suggests you have a much better possibility of discovering a mortgage car loan in the UAE that flawlessly fits your requirements, including specialized items that might not be offered with typical banking networks. Browsing the mortgage market can be confusing, especially with the myriad of products readily available. A provides professional advice, helping you understand the benefits and drawbacks of each alternative.

Getting My G. Halsey Wickser, Loan Agent To Work

This specialist suggestions is indispensable in protecting a home mortgage that straightens with your monetary objectives. Mortgage consultants have established connections with several lending institutions, giving them substantial negotiating power.

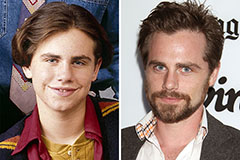

Rider Strong Then & Now!

Rider Strong Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!